Lewis Pearson Promoted to Director at DTE Corporate...

We are delighted to announce that Lewis Pearson, after a decade of dedication to the group, has been promoted to…Read More

Due to the effect of the Covid-19 pandemic on the global economy, many Managed Service Providers (MSPs) had to rapidly adapt to the changing needs of their clients.

As the UK entered prolonged periods of lockdowns, there was an immediate shift to a workforce, now operating from their own homes. As well as the requirements for MSPs to support the new needs of their clients.

The monumental demand in mid-2020 for IT hardware and software, as companies adapted to the new challenges of no longer being office based, at a time when global supplies of laptops and other IT hardware were rapidly dwindling, was a major challenge for many MSPs.

The challenges caused by the pandemic, and the solutions found by many MSPs, highlighted further the importance of a strong working relationship with its client base to allow them to continue with minimal disruption. This presented the providers with new opportunities to expand their offering during these unprecedented times.

As we are now emerging from the other side of the worst effects of the pandemic, the TMT sector must continue to adapt to the ‘new normal’ and consider the following:

At DTE Corporate Finance we have worked with several MSPs who have bounced back even stronger from the pandemic. They are now in an acquisitive mood to capitalise further on their gains and to be successful, as the economy continues to adapt to a new normal hybrid way of working.

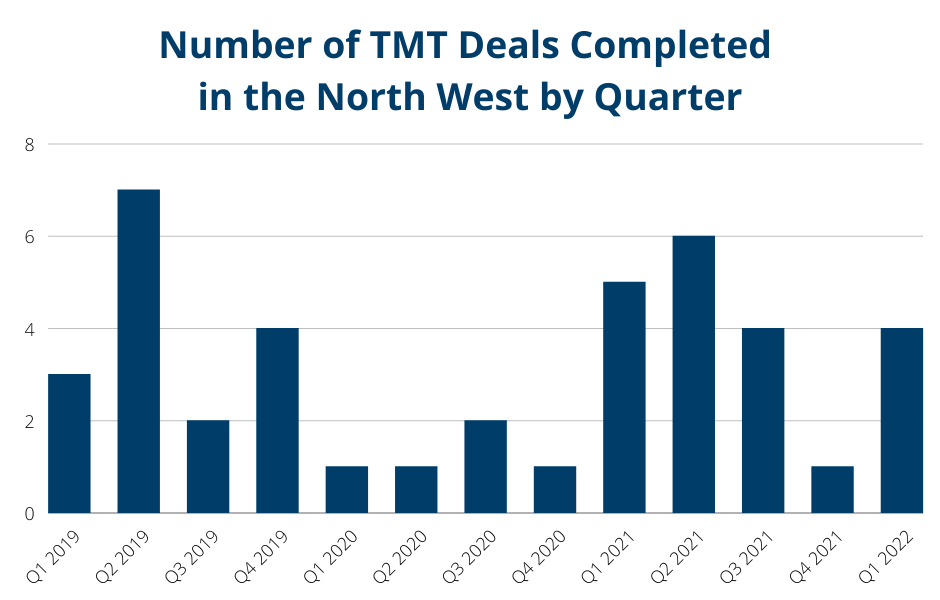

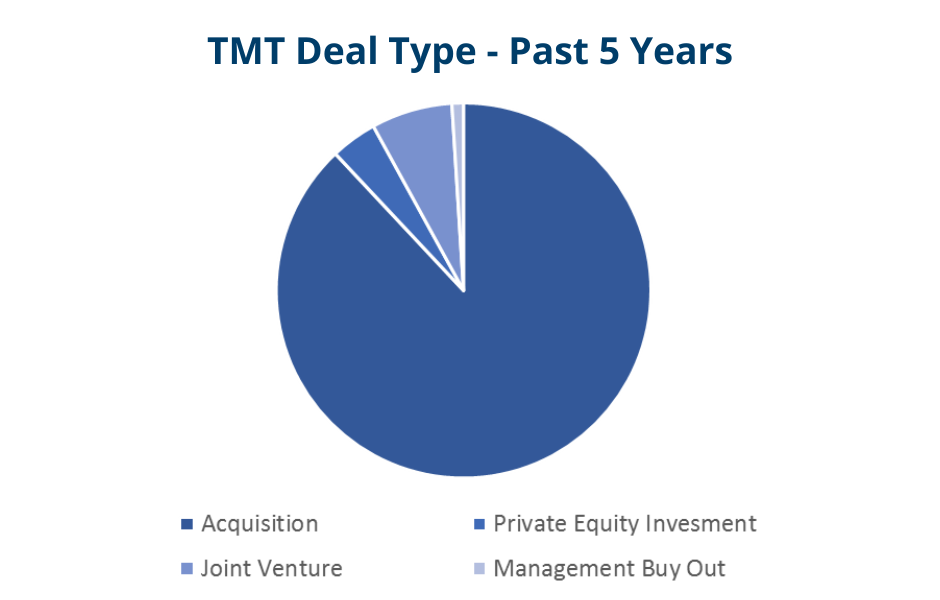

In recent months, we have seen keen interest from both trade buyers and private equity investors, eager to take advantage of a buoyant market.

Valuation multiples have always had significant range in the sector. However, companies will see EBITDA (earnings before interest, taxes, depreciation, and amortization) multiples at the higher end of the range if they are able to show the following:

There is now an increased demand for MSPs to provide a full product offering, which will also help to drive valuations.

We have extensive experience in carrying out a full range of Due Diligence, Lead Advisory and Business Valuations across the TMT sector for a variety of purposes.

To discuss your business requirements, please contact a member of our Corporate Finance team in Manchester, or email Matt Beckley directly.

We are delighted to announce that Lewis Pearson, after a decade of dedication to the group, has been promoted to…Read More

The Chancellor, Rachel Reeves, delivered her first budget to the House of Commons this afternoon. This Autumn Budget has been…Read More

We are excited to share that Kate Hughes and Richard Askey have both been promoted to Partner. At DTE we…Read More